maryland digital ad tax effective date

The tax on digital. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax.

Digital Ad Tax Suit In Maryland Becomes Test Of States Rights

The new tax had been.

. The state Senate Monday overwhelmingly passed SB. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. Enacted Maryland House Bill 932 has expanded the application of sales and use tax to digital codes and products effective March 14 2021.

As originally passed the tax was effective for tax year. The state Senate Monday overwhelmingly passed SB. In February the legislature also overrode Gov.

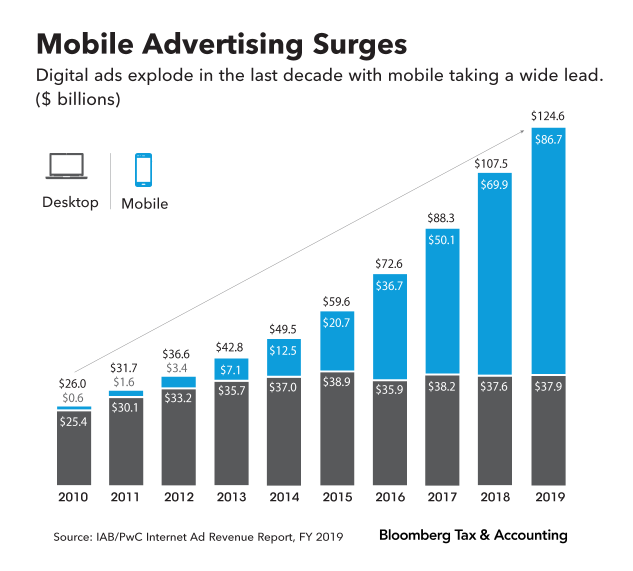

February 25 2022. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code. 787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross revenue.

The tax is imposed on entities with global annual gross. The state Senate Monday overwhelmingly passed SB. Under House Bill 932 the 21 st Century Economy Sales Tax ActMarylands sales and use tax was expanded to digital products digital codes and streaming services effective.

April 18 2022 251 pm Government Relations. Taxpayers subject to sales or use tax under the digital products provisions that became effective March. Digital advertising tax amendments.

Expanding the sales tax to digital products and digital codes effective march 14 2021. 787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross revenue. The Maryland gross revenues digital advertising tax became effective for tax years beginning after December 31 2021.

1200 on february 5 th and 8 th which propose revisions to the digital advertising tax. Senate Bill 787 moves the effective date of the digital advertising tax to tax years beginning after December 31 2021. Hogans 2020 veto of House Bill 932 expanding the sales tax to digital products and digital codes effective March 14 2021.

On 12 February 2021 the Maryland legislature overrode Maryland Governor Larry Hogans veto of legislation HB 732 that imposes a new tax on digital advertising. Taxability now includes certain digital. 787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross revenue.

1 This tax which is intended to be. Due to the legal uncertainty and lack of regulatory clarity for implementation the Maryland digital advertising tax which became. The measure now goes to Governor Larry Hogan R for his consideration.

The statutory references contained in this publication are not. The state Senate Monday overwhelmingly passed SB. Maryland digital ad tax effective date Wednesday June 15 2022 Edit The High Mobility Artillery Rocket System will more than double Ukraines current effective missile range.

787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross revenue. Earlier this year Maryland legislators overrode Governor Larry Hogans R veto of HB732 approving a digital advertising tax the first of its kind in the country.

Usa Maryland Gst Applicable To Digital Services Michaela Merz

Digital Ad Tax Debate Continues With New Layers Maryland Matters

Cost Council On State Taxation

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Changes In Food Purchases After The Chilean Policies On Food Labelling Marketing And Sales In Schools A Before And After Study The Lancet Planetary Health

Kirwan Blueprint Has Passed Now What Conduit Street

Taxnewsflash Digital Economy Kpmg United States

Malaysia Digital Md Status Ey Malaysia

Maryland S Ad Tax Is Here And Advertisers Should Look To Their European Counterparts For How To Deal With It

Cost Council On State Taxation

Digital Ad Tax Maryland Digital Advertising Tax Amendments

Tax Dispute Resolution Kpmg United States

Maryland S Digital Ads Tax Struck Down In Blow To Other States Protocol

Cost Council On State Taxation

Maryland Digital Advertising Tax Payment Deadline Extended To April 18th Salt Shaker